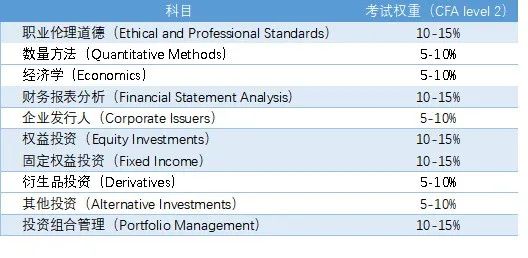

2023年CFA二级考试大纲已经发布出来了,各科目考试权重和去年一致,虽然有新增部分,但也有部分考纲被删除,整体难度并没有增加,所以大家也不用恐慌。我们来看看吧。

1. 各科目考试权重和去年一致,没有发生变化

2. 取消了之前Reading的概念,改为了现在的module,从而更好地与官网学习系统契合。

1. 考纲细则无变动的科目

固收:原来的5个Reading现调整为5个Learning Module。考纲细则无变动。

道德:原来的3个Reading现调整为3个Learning Module。考纲细则无变动。

衍生:原来的2个Reading现调整为2个Learning Module。考纲细则无变动,仅顺序有一定微调。

经济:原来的3个Reading现调整为3个Learning Module。考纲细则无变动。仅将原Reading 7 Economic growth and the investment decision的标题变成Learning Module 2 Economic growth,考纲细节内容无变动。

另类:原来的3个Reading现调整为5个Learning Module。考纲细则无变动。但新考纲Module 3 LOS a-b,将原考纲k, l中对REITS的描述改为publicly traded real estate securities。

2. 考纲细则删除的科目

组合:原来的7个Reading现调整为7个Learning Module。

原Reading 42 Economics and investment markets对应的是Learning Module 5。

其中删除了一条考纲k describe how economic analysis is used in sector rotation strategies。

权益:原来的8个Reading现调整为4个Learning Module。

删除Reading 21 Return concepts收益概念和Reading 22 Industry and company analysis公司和行业分析,其余部分考纲细则不变,仅考纲顺序进行了微调。

3. 考纲细则新增的科目

财报:原来的6个Reading现调整为7个Learning Module。

新增考纲:Financial Statement Modeling财务报表建模

全章节新增,部分内容与2022年权益Reading 22 Industry and company analysis行业和公司分析接近。

新增考纲细则如下:

(1)compare top-down, bottom-up, and hybrid approaches for developing inputs to equity valuation models

(2)compare “growth relative to GDP growth” and “market growth and market share” approaches to forecasting revenue

(3)evaluate whether economies of scale are present in an industry by analyzing operating margins and sales levels

(4)demonstrate methods to forecast cost of goods sold and operating expenses

(5)demonstrate methods to forecast non-operating items, financing costs, and income taxes

(6)describe approaches to balance sheet modeling

(7)demonstrate the development of a sales-based pro forma company model

(8)explain how behavioral factors affect analyst forecasts and recommend remedial actions for analyst biases

(9)explain how competitive factors affect prices and costs

(10)evaluate the competitive position of a company based on a Porter’s five forces analysis

(11)explain how to forecast industry and company sales and costs when they are subject to price inflation or deflation

(12)evaluate the effects of technological developments on demand, selling prices, costs, and margins

(13)explain considerations in the choice of an explicit forecast horizon

(14)explain an analyst’s choices in developing projections beyond the short-term forecast horizon

数量:原来的5个Reading现调整为7个Learning Module。

删除原Reading 1 Introduction to linear regression一元线性回归内容下放到一级数量中的最后一个模块。

原Reading 2 Multiple regression多元回归内容拆分成4个模块module 1-module 4。

与原Reading 2考纲细节做比对,考纲的顺序、表示和知识点都有较大变化,部分考纲进行了拆分,变化结果如下:

考纲删除3条:

(1)formulate a null and an alternative hypothesis about the population value of. a regression coefficient, calculate the value of the test statistic, and determine whether to reject the null hypothesis at a given level of significance;

(2)interpret the results of hypothesis tests of regression coefficients;

(3)evaluate and interpret a multiple regression model and its results.

考纲新增2条:

(1)describe the types of investment problems addressed by multiple linear regression and the regression process

(2)describe influence analysis and methods of detecting influential data points

原Reading 4对应的是module 6。其中新增了一条考纲f describe supervised machine learning, unsupervised machine learning, and deep learning.

公司金融:考纲变动最大的科目。原来的5个Reading现调整为4个Learning Module。

删除原Reading 15 Capital Structure资本结构章节和Reading 19 Capital Budgeting资本预算章节,精简并下放到一级。

新增:Cost of Capital: Advanced Topics

新增考纲细则如下:

(1)explain top-down and bottom-up factors that impact the cost of capital

(2)Compare methods used to estimate the cost of debt.

(3)explain historical and forward-looking approaches to estimating an equity risk

premium

(4)compare methods used to estimate the required return on equity

(5)estimate the cost of debt or required return on equity for a public company and a private company

(6)evaluate a company’s capital structure and cost of capital relative to peers

原Reading 18 Measures and Acquisitions兼并收购章节调整为Learnings Module 4 Corporate Restructurings企业重组,章节内容完全重写,新增内容为各种公司重组事件、他们的分析和纳入财务模型的预测和估值。

企业重组模块考纲细则如下:

(1)explain types of corporate restructurings and issuers’ motivations for pursuing them

(2)explain the initial evaluation of a corporate restructuring

(3)demonstrate valuation methods for, and interpret valuations of, companies involved in corporate restructurings

(4)demonstrate how corporate restructurings affect an issuer’s EPS, net debt to EBITDA ratio, and weighted average cost of capital

(5)evaluate corporate investment actions, including equity investments, joint ventures, and acquisitions

(6)evaluate corporate divestment actions, including sales and spin offsevaluate cost and balance sheet restructurings

虽然CFA二级考纲中有新增的部分,但也有部分考纲被删除,整体难度并没有增加,所以大家也不用恐慌。

对于备考新手来说,无需太过关注之前的考纲,只需要按照新考纲去备考即可。

对于“二战”考生来说,则需要关注一下组合和权益科目中删除的考纲,避免增加学习负担。此外需要特别注意:财报、数量和公金科目,尤其是变动幅度最大的公金。

本文由高顿金融分析师原创编辑,作者:向俊。