2021年ACCA6月考季即将要开始了,从历年考情,Bad debt&Doubtful debt是大家经常会有问题的一个知识点,对此会计网通过几道经典的例题来为大家详解该知识考点。

01、What is Bad debt&Doubtful debt

1. Dad debt:

If a debt is definitely irrecoverable it should be written off to statement of profit or loss as a bad debt.

对应收账款影响:减少Trade receivable balance

2.Doubtful debt:

If a debt is possibly irrecoverable an allowance for the potential irrecoverability of that debt should be made.

分类:

1)Specific allowance:

针对某个特定客户的坏账准备(Particular/named individual customer)。

2)General allowance=(Trade receivable balance - Bad debt - Specific allowance)*n%

公司跟据以往经验确定一个Trade receivable减去Bad debt和Specific allowance后可能发生坏账的百分比。

对应收账款影响:不减少Trade receivable balance

02、Initial recognition

1.Bad debt:

Dr Receivable expense(SPL)

Cr Trade receivables(SOFP)

2. Specific allowance&General allowance

Dr Receivable expense(SPL)

Cr Allowance for receivables(SOFP)

03、Subsequent change in bad debt and doubtful debt

1.Initial bad debt->Subsequent recovered(坏账收回)

直接记录收到了现金,抵消过去记录的坏账费用,不影响Trade receivable:

Dr Cash

Cr Receivable expense

2.Initial specific debt->Subsequent recovered(坏账准备收回)

1)第一步:抵消过去记录的坏账准备:

Dr Allowance for receivables

Cr Receivable expense

2)第二步:记录我们收到的现金:

Dr Cash

Cr Trade receivables

3. Initial specific debt->Subsequent go bad(坏账准备变成坏账)

因为坏账准备和坏账都是Receivable expense且坏账准备变成坏账时金额没有发生改变,所以坏账准备变成坏账不影响Receivable expense,也不影响Profit:

Dr Allowance for receivables

Cr Trade receivables

04、Receivable expense的计算

Receivable expense = Bad debt + Movement in allowance

= Bad debt + (Closing allowance - Opening allowance)

05、例题

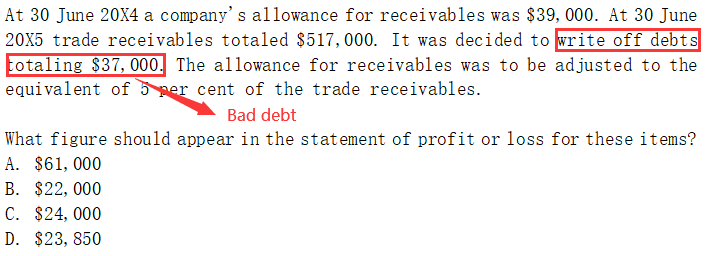

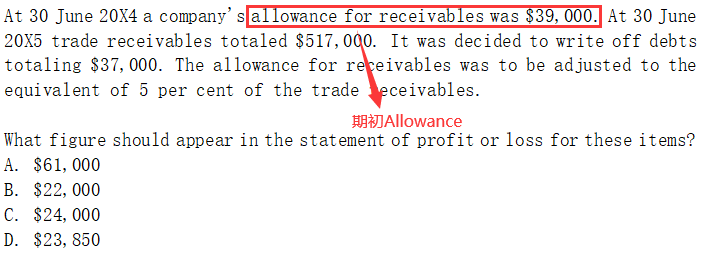

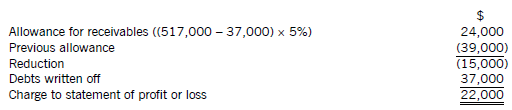

At 30 June 20X4 a company's allowance for receivables was $39,000. At 30 June 20X5 trade receivables totaled $517,000. It was decided to write off debts totaling $37,000. The allowance for receivables was to be adjusted to the equivalent of 5 per cent of the trade receivables.

What figure should appear in the statement of profit or loss for these items?

A. $61,000

B. $22,000

C. $24,000

D. $23,850

分析:题目让求在利润表中记录的坏账和坏账准备的费用的金额,也就是求计入利润表的Receivable expense。

Step1:

Receivable expense = Bad debt + Movement in allowance

= Bad debt + (Closing allowance - Opening allowance)

Step2:

Bad debt题目信息直接给了=37000

Step3:

Movement in allowance = Closing allowance - Opening allowance

= (517000-37000)*5% - 39000 = -15000

Step4:

Receivable expense = Bad debt + Movement in allowance = 37000-15000 = 22000

所以这道题答案选择B。

以上就是我们坏账和坏账准备的内容,重点需要大家掌握的就是:

1、 Allowance的计算

2、Receivable expense的计算

3、坏账收回,坏账准备变坏账,坏账准备收回的会计处理

来源:ACCA学习帮